Manage your own money well, you are the real betting master (Part 1)

Money management is not a small probability event that you bought a $2 lottery ticket and won 5 million, but through money management slowly snowballing from $2 to $20 or $200, how can we achieve such a super high return on money through money management?

In the entire betting operation, most people discuss technical analysis and team prediction, but rarely mention money management. However, whether it is investment or speculation, the rational use of money is a prerequisite for gaining advantages.

In all operations, in fact, the risk can be artificially reduced, that is, you don't pick fruits that are too high. Perhaps the fruit at high places is sweeter, but it is also more dangerous. We use money management to slowly pick those ordinary fruits and we can still obtain satisfactory wealth.

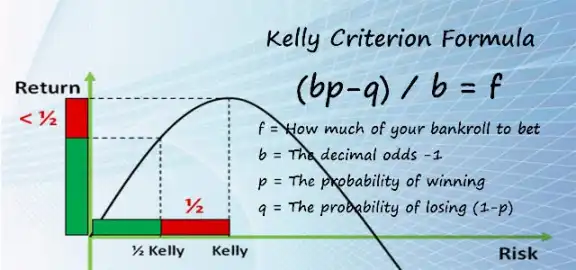

When it comes to money management, we have to mention the famous 'Kelly Criterion' in the investment field.

John Kelly developed his formula whilst working at AT&T's Bell Laboratory when attempting to solve their long-distance signal noise issues. It was first repurposed as a formula to identify an optimal betting system in horse racing. It allowed gamblers to increase the size of their winnings over a long period of time.

In current times, the Kelly Criterion is used for a similar purpose for investors around the world. Two simple components make up the Kelly Criterion, the first is the probability that a trade you make will return positive winnings – and the second is the win/loss ratio.

The win/loss ratio is self-explanatory, and you can calculate it by dividing the positive volume by the negative volume. Then insert the above two factors into the formula, where the output is a percentage. This percentage amount is critical to investors because it enables them to understand how much of the portfolio should be allocated for each investment.

In the next article(Part 2), I will analyze the practical application of Kelly Criterion in more detail for you.